Accounting Services for Limited Companies

Simple & Flexible Pricing

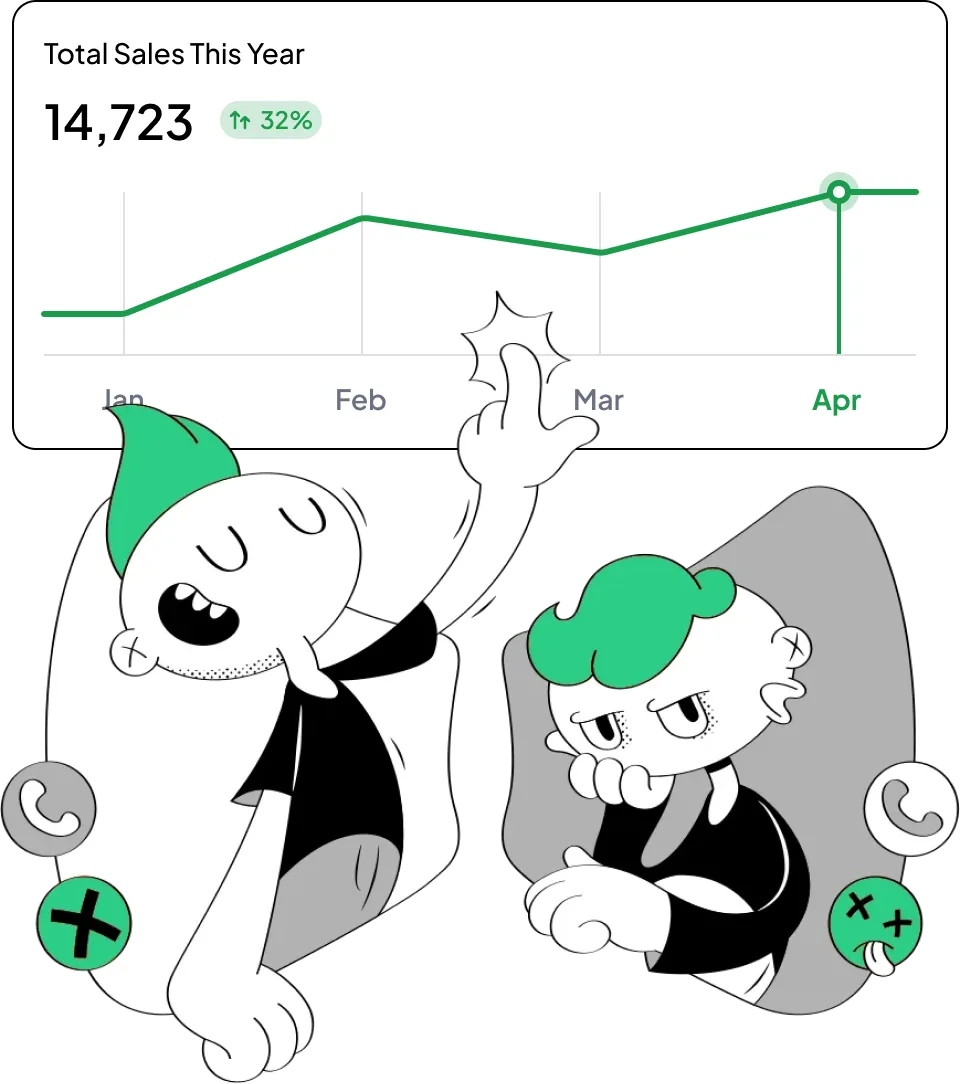

Starting at Just £70 per Month

All-In-One Accounting & Support for Your Business

What’s Included in Our Limited Company Accounting Services

- Tax Registrations

- Bookkeeping at Ease

- Self-Assessment Tax Filing for Director

- Confirmation Statement

- Payroll & Dividends

- Statutory Annual Accounts

- Corporation Tax return

- Quarterly VAT Returns (If VAT registered)

- Company Formation (Additional £120 Applies)

- Support from a UK Qualified Accountant

- Digital Accounting Software

- Accountant Reference Letters

- Cancel Anytime

- Key Deadlines Notifications

- Tax Efficiency Reviews & Advice

All the Accounting Stuff Combined with Excellent Customer Service

No trading activity in the last year? We do Dormant Company Accounts at £225 per year, without any hidden fees.

No trading activity in the year?

We do Dormant Company Accounts for £225/year—no hidden fees.

Understanding Our Fees (Sample Scenario)

Client Profile:

Services Required:

- Annual (Statutory) Company Accounts

- Corporation tax return

- Monthly payroll

- Annual Confirmation Statement

- Personal Self-Assessment Tax Returns for Both Directors

Pricing Details

- £70/Month: Limited Company Accounting

including the director’s personal tax return. - £12/Month: Additional Payroll for second employee

- £20/Month: Additional employee’s self-assessment tax return

Total Monthly Cost: £102

This comprehensive package ensures that both your company’s and personal financial obligations are met, with transparent pricing tailored to your specific needs.

Understanding Our Fees (Sample Scenario)

Curious about our pricing? Take a look at a typical fee breakdown for a specific client scenario:

Client Profile:

Services Required:

- Annual (Statutory) Company Accounts

- Corporation tax return

- Monthly payroll

- Annual Confirmation Statement

- Personal Self-Assessment Tax Returns for Both Directors

Client Profile:

You own a Limited Company (not VAT-registered) and provide software engineering services with minimal complex transactions. You and your spouse, the only employees, receive both salaries and dividends from the company.

Services Required:

- Annual (Statutory) Company Accounts

- Corporation tax return

- Monthly payroll

- Annual Confirmation Statement

- Personal Self-Assessment Tax Returns for Both Directors

- £70/Month: Limited Company Accounting including the director’s personal tax return.

- £12/Month: Additional Payroll for second employee

- £20/Month: Additional employee’s self-assessment tax return

Industries We Serve:

Why Work With Us?

Competitive Pricing

Expert sole trader accounting at a fair, transparent price. Our fixed pricing model ensures you get top-tier service without unexpected costs—quality support at the right value.

Licensed & Regulated

We are AAT-licensed and HMRC-approved accountants, ensuring full compliance with UK tax laws—one more reason to trust us for secure, professional, and precision-driven accounting.

Unlimited Support

Tax and accounting questions? We’re here for you 7 days a week. Whether you need quick guidance or in-depth advice, our expert team is always ready to assist.

UK-Wide Service

Our services are fully online, supporting clients across the UK—but you’re always welcome to visit our office if you prefer in-person assistance. The choice is yours!

Software integrations

Connect your finances with only what you need—Xero, QuickBooks, A2X, Dext, and more. We recommend software based on your business and industry, helping you avoid unnecessary costs.

Testimonials

Client Experiences, Unfiltered

- 5

Furkan Yilmaz

- 5

I have been using accounting services from Leon Advisers for 4 years and am greatly satisfied with their services. Ali has been very attentive and responsive to all of my questions, and he has been proactive in avoiding any potential problems by sending regular reminders of upcoming payments and documentation. He has made the transition to self-employment super smooth for me and was always very accessible in answering any immigration-related questions. I will definitely continue to work with them in the future.

Aydanur Baran

- 5

I have been living in London for approximately 4 years, and I moved here under the Ankara Agreement. Since the day I arrived, Mr. Ali Ihsan has been responsible for the accounting matters of my company. When I first came, I had no idea about the processes I needed to complete (such as company registration and other paperwork). Mr. Ali handled everything for me from A to Z, as if he were an accountant working exclusively for me.

He patiently answered all my questions, even those unrelated to accounting, without any hesitation. In this country, he has gone above and beyond to assist me with both my accounting needs and personal matters (such as bank accounts, police registration, etc.). I am incredibly grateful for all his support. I look forward to working with him for many years to come.

Gokberk Pinar

- 5

We’ve been working for almost a year now. Great service, great people